Cybersecurity and enterprise risk management erm are two disciplines you d think would be fully integrated at most organizations.

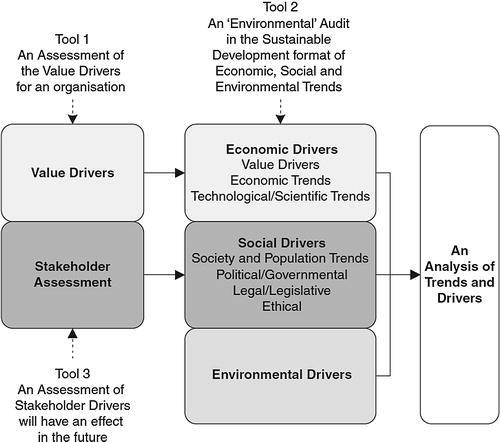

Explain key drivers of value driven enterprise risk management.

This range of savings was cited in communications with the author by ethicare advisors a firm engaged in hospital bill review.

Sons inc march 2011.

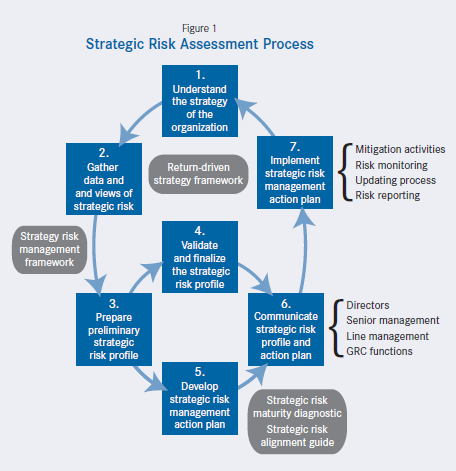

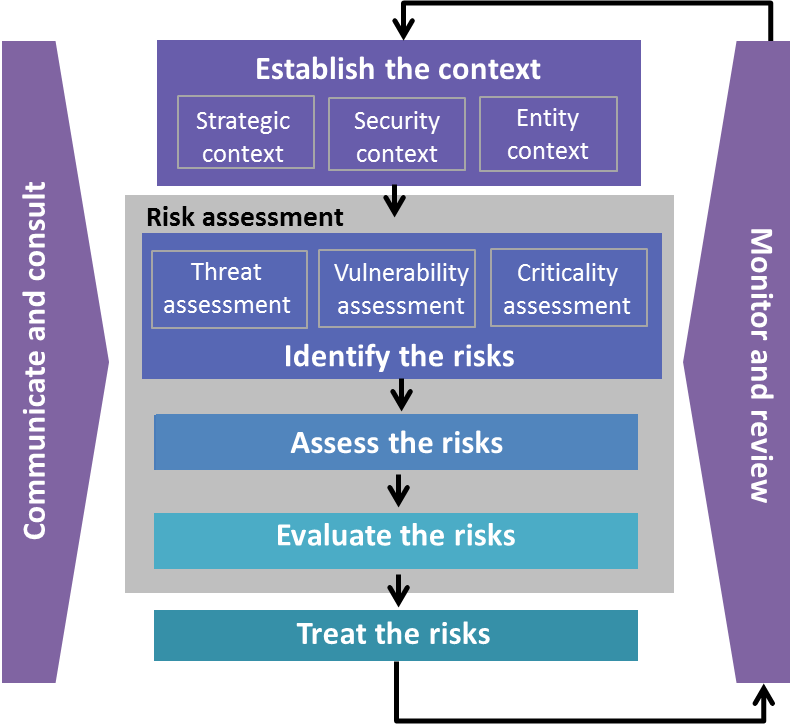

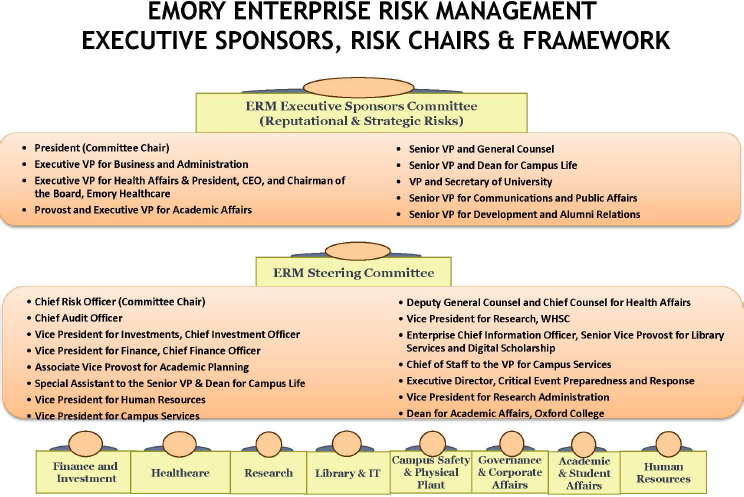

Before adopting leading risk management concepts for risk identification analysis mitigation monitoring and reporting the organisation should first decide on its risk management priorities objectives approach and risk governance structure based on its.

The next step in business management john wiley amp.

It is good business.

The benefits of enterprise risk management erm are getting a lot of attention in the.

1 stanford strategic decision and risk management certificate program stanford california usa.

A progressive argument or driver of value creation.

Rsm s 8 drivers of effective enterprise risk management.

Segal s corporate value of enterprise risk management.

Quantifying the impact on value is the key to making the business case for erm.

As a result they lack valuable information.

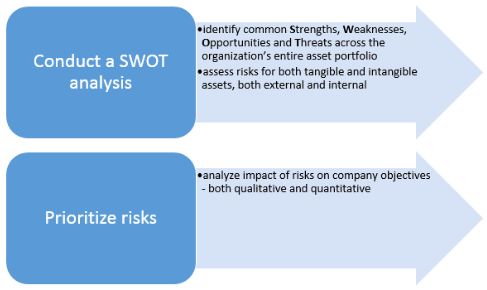

Many companies start with a traditional checklist approach and limit their evaluation to risks that are identified in surveys.

Celona j 1 driver j hall e.

Enterprise risk management erm began as an effort to integrate the historically disparate silos of.

However practice does not indicate the same.

After all erm is the process of managing risks and identifying threats to an organization as a whole two tasks key to cybersecurity in general.

Based on theory and case studies the following drivers for risk management have been identified.

The integrated net combined impact of two or more simultaneous risks.

A simplified example of such a model is shown in chart 2a page 35.

The enterprise wide correlation adjusted impact.

Making erm an engine for simultaneous value creation and value protection.

Risk management s official argument is clear.

Three defensive arguments or drivers of value preservation.

Designed to quantify the enterprise wide integrated impacts of risk on shareholder value.

The impact of risk on shareholder value rather than on current period metrics.

The model presents a partial list of internal and external risk drivers on left of chart and the items that they impact downstream moving to the right ultimately impacting the valuation.

Link objectives strategies and risks to key risk indicators in order to integrate enterprise risk management into decision making processes.

A value driven approach encompasses a forward looking probabilistic analysis for the quantification of the overall uncertainty in the value of an enterprise with a clear identification of the.